- Investment Case

- Investor Days

- Corporate Transactions

- Shareholder Centre

- Annual Reports

- Results & Presentations

- Press Releases & News

- Financial Calendar

- Financial Summary

- Debt Summary

- Tax Approach

- Advisors & Analysts

- Pension Schemes

- Corporate Governance

- Frequently Asked Questions

- Investor Relations Contacts

Debt Summary

Informa aims to maintain a strong balance sheet and flexible funding mix, creating long-term visibility and liquidity in its financing.

We have public bonds under a Euro Medium Term Note programme and also make use of bank facilities for short-term and revolving financing needs. We expect to continue to be in a net borrowing position for the foreseeable future.

Liquidity risk is managed by maintaining adequate reserves and debt facilities, continuously monitoring forecast and actual cash flows against the maturity profiles of our financial assets and liabilities, and borrowing in currencies in which the Group operates, principally GBP, USD and EUR, to hedge projected future cash flows.

- Capital Structure

- Facilities

- Maturity Profile

- Ratings

- Issuers and Guarantors

- Contacts

Strong Visibility and Attractive Cash Flow Dynamics

Informa has visible and predictable revenue streams, with a large proportion of annual income booked in advance through subscriptions or forward bookings for events. This generates attractive cash flow characteristics.

-

Cash Conversion %

-

Free Cash Flow (£m)

-

Net Debt/Covenant EBITDA

Current Debt Facilities

Informa issues fixed-term debt in a range of maturities, borrowing in US Dollars, Euros and Pounds Sterling. The Group currently has two public bonds issued under Euro Medium Term Note programmes and a number of US Private Placement notes.

Informa also makes use of shorter-term revolving credit bank facilities, provided by an international syndicate of banks.

Term Debt

| Issuer | Format | CUSIP/ISIN | Currency | Amount (m) | Maturity | Original Term | Coupon |

| Informa PLC | EMTN | XS1853426549 | EUR | 650 | 05-Jul-23 | 5 Year | 1.50% |

| Informa PLC | EMTN | XS1853426895 | GBP | 300 | 05-Jul-26 | 8 Year | 3.125% |

| Informa PLC | EMTN | XS2251329178 | GBP | 150 | 05-Jul-26 | 8 Year | 3.125% |

| Informa PLC | EMTN | XS2068065163 | EUR | 500 | 22-Apr-28 | 8.5 Year | 1.25% |

| Informa PLC | EMTN | XS2240507801 | EUR | 700 | 06-Oct-25 | 5 Year | 2.125% |

Bank Facilities

| Borrower | Format | Currency | Amount (m) | Original Term | Coupon |

| Informa PLC | Revolving Facility | GBP | 450 | 3 Year | Floating |

| Informa PLC | Revolving Facility | GBP | 600 | 5 Year | Floating |

Flexible, long-term financing

We aim to maintain a balanced and flexible mix of funding sources on attractive terms, manage our maturity profile and the overall weighted average cost of debt.

As at the end of 2018, the Group’s maturity profile was 5.2 years and overall weighted average cost of debt was around 3.7%.

To reflect the growth and breadth of the Group, the size of our revolving credit facility and the number of syndicate of banks providing the facility was increased during 2018.

-

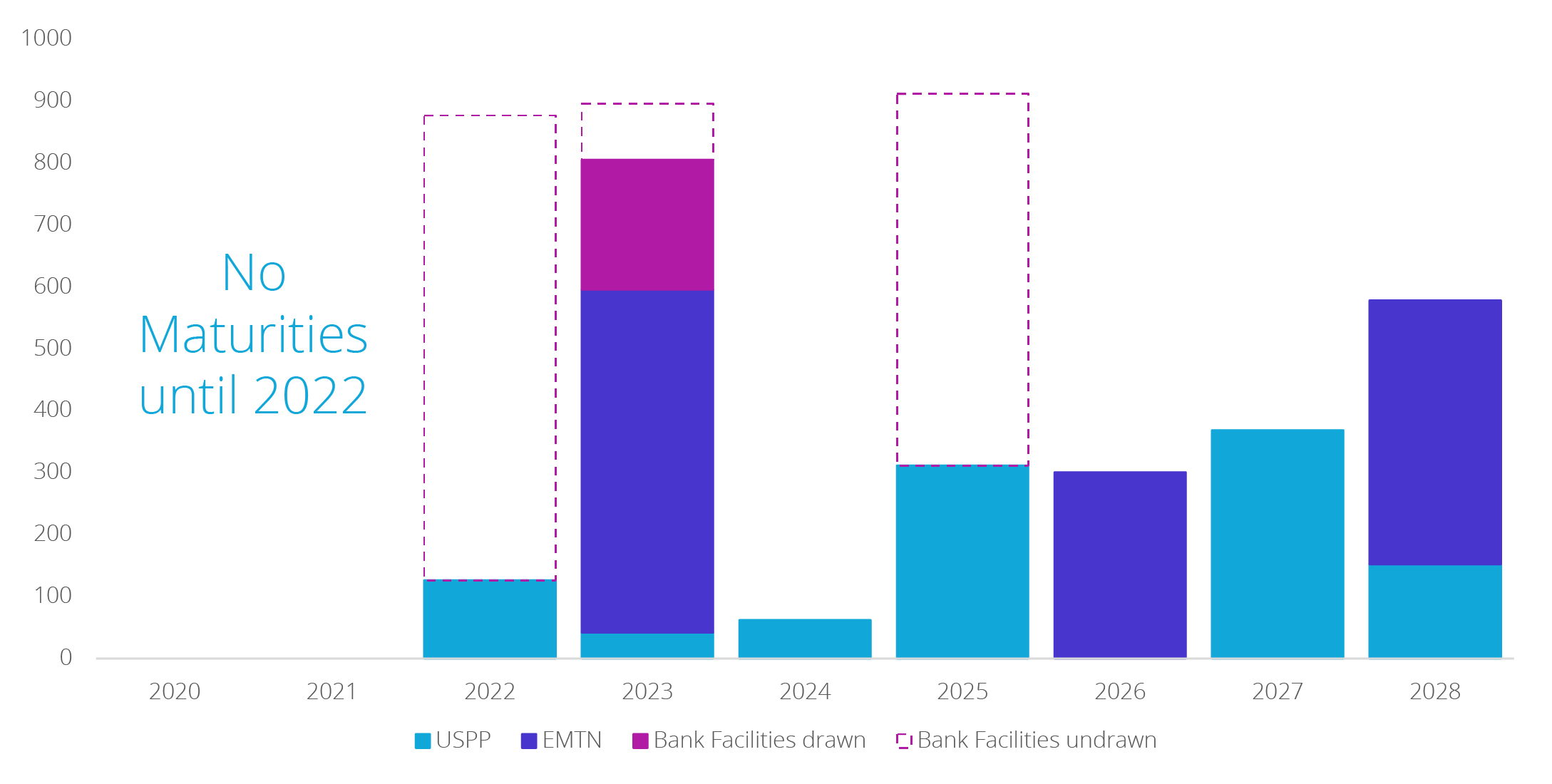

Pro-forma debt maturity as at 31 Dec 2019 (£m)1

1Proforma for: (1) RCF +1 Extension executed Jan 2020; (2) Dec 2020 USPP Prepayment executed Feb 2020; (3) Surplus Committed Credit Facility Mar 2020

Ratings

As an issuer of public debt, Informa has been assigned credit ratings by S&P Global Ratings Europe Limited and Moody's Investors Service Ltd. UBM plc, which became part of Informa in 2018, had USD350 million of senior unsecured notes due to mature in 2020, which remain rated Baa3.

| Issuing Companies | S&P | Moody's |

| Informa PLC | BBB- | Baa3 |

Issuers and Guarantors

Informa comprises a number of different operating, holding and financial companies, and a full list of subsidiaries, associates and joint ventures is available in the Notes section of the latest Informa Annual Report. For all classes of the Group's senior unsecured debt, the guarantor structure is as follows.

| Guarantors and Issuer | ||

| Informa PLC (UK) | Informa Group Holding Limited (UK) | |

For more information about Informa's debt programme, contact the Group Treasurer.

Richard Garry

Group Treasurer

5 Howick Place

London

SW1P 1WG

UK

Telephone: +44 (0)20 7017 5000

Email: treasury@informa.com